In recent years, Americans have spent more time in Europe, expanding their businesses outside the US, acquiring holiday homes or yachts in the Mediterranean, and opening their children to European colleges and universities, the European job market or European sports clubs. To achieve this, Americans seek to revive their American ancestral roots or explore opportunities for European residency or citizenship by investment routes. Malta ticks all the right boxes as an entry point to Europe and discretely comes out on top.

Reasons why Americans seek European Residency

Americans seek European residency and eventually citizenship for a number of reasons. A second residency in Europe grants an American citizen the right to relocate, live, study, work, invest, do business, and retire in Europe. For children, this is a steppingstone to the European job market, to European schools, colleges and universities, as well as European sports clubs. High net worth Americans may also legally build a base for the management of their non-US assets.

So what is European Residency?

It is important to make a distinction between residency and citizenship. When we refer to European Citizenship, we refer to a passport issued by one of the 27 member states of the European Union. Nationality of any one of the member states in the EU, grants the right to live, work and study in all the EU member states. ‘European Citizenship’ translates into the enjoyment of rights enshrined by the treaties establishing the European Union, including the freedom of movement of persons, goods and capital and the freedom of establishment.

On the other hand, European Residence gives the right to reside indefinitely in the country in which the investor decides to invest in, and also gives the right to travel within the Schengen Area without a visa. Holders of a residence permit issued by a member of the Schengen Area allows its holder the right to also stay in the Schengen Area for 90 days in a six-month period.

Routes to European Residence or Citizenship for American Investors & Entrepreneurs

While some Americans are blessed with European ancestry that may, in some cases entitle them to claim their ancestral European citizenship through descent, eligibility is often limited, the process bureaucratic and this route to European citizenship is often difficult due to burdensome process of sourcing old birth certificates. A more preferred route for investors or business families is to acquire residence or citizenship by investment in a European country that allows a route to naturalisation as a citizen of that country, by investment.

Malta, a Mediterranean island state in the EU enjoying a family-friendly, safe environment and the lowest unemployment rate in Europe, has 2 separate investment migration programmes: Malta Permanent Residence Programme and Malta Citizenship by Direct Investment.

Malta maintains a robust due diligence process to ensure that only fit and proper investor families are offered the privilege of obtaining residency or citizenship.

Malta Permanent Residence Programme

Malta’s residence by investment Programme, formally known as the Malta Permanent Residence Programme grants applicants and eligible family members the right to live indefinitely in Malta and the right to travel within the Schengen Area without a visa. In order to be eligible, applicants must show that they have in their possession, capital of not less than €500,000, out of which €150,000 must be in the form of liquid financial assets such as bank account balance or funds invested in securities. Alternatively, the applicant can show a capital of €650,000 with at least €75,000 in financial assets.

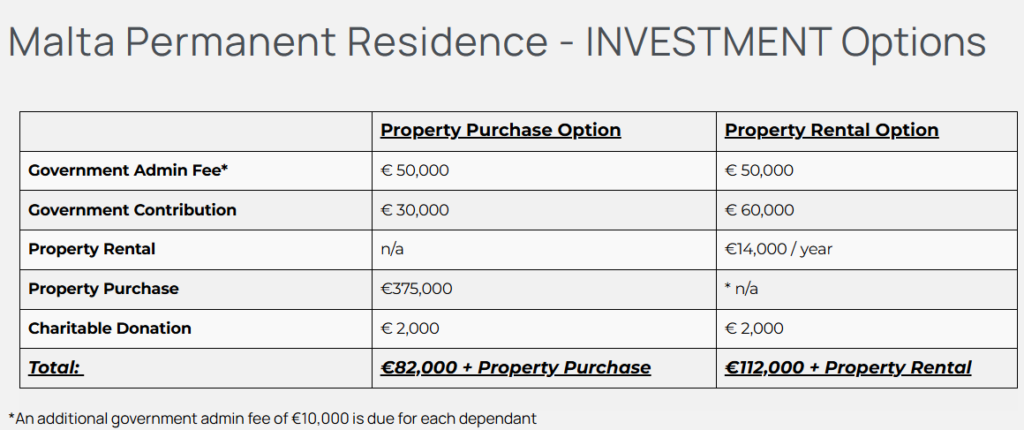

The process from submission until approval takes between 6 and 12 months and the investment is only required to be made, once a letter of approval is issued by the Residency Malta Agency. Applicants are to undergo a due diligence test, after which they will be required to fulfil the qualifying investments which include:

- The rental or purchase of property in Malta or Gozo with a minimum spend of €375,000 (if purchasing) or €14,000 per year (if renting). The property is to be kept for a minimum of 5 years.

- A donation to a charity or a philanthropic organisation of €2,000, and

- A government contribution and administrative fee of €110,000 if renting a property or €80,000 if purchasing a property. An additional contribution of €10,000 applies per dependant.

Malta Citizenship for Investors

Under Malta’s Rules for Naturalisation by Direct Investment, the privilege of naturalising as a Maltese citizen is only extended to an American family upon successfully completing all the eligibility requirements. These include evidence of personal, social, and commercial integration during the 3 or 1-year legal residency period. It is only upon receiving the last approval that the investor must make the one-time non-refundable direct investment (€600,000 – €750,000) to the Government (these funds are managed and deployed in projects of national importance for the social and economic development of Malta).

There are three main requirements to apply for Maltese Citizenship by Investment:

- A contribution of €600,000, or €750,000 to reduce the time-to-citizenship from three to one year. A contribution of €50,000 applies to include additional family members, and

- The purchase or rental of a residential Property in Malta at a minimum value of €700,000 (if purchasing) or €16,000 per year (if renting) for a minimum of 5 years.

- A donation of €10,000 to a local charity/philanthropic organisation

Cyprus, an island member state used to allow investors to naturalise through the purchase of a portfolio of €2.5 million in real estate. Unfortunately, this programme closed in 2020. Cyprus still offers a residence by investment programme, but this only grants the rights to reside in Cyprus. A Cypriot residence card doesn’t allow visa-free access to the Schengen Area since the country is not a signatory to the Schengen Agreement.

Portugal grants a ‘Golden Visa’ that is legally a temporary residency renewable every two years, subject to demonstrating a minimum physical stay of 7 days in the first year and 14 days in subsequent years. For American families who settle in Portugal, demonstrate integration in Portugal and pass the Portuguese language test, this opens the opportunity of applying to Portuguese long-term residence and eventually citizenship. Citizenship is not an automatic right though and is subject to these integration and language requirements which not all American families are able to meet, hence the popularity of the Malta route that is shorter and better defined.

Malta: Legal and Tax Considerations

English is an official language in Malta and also the language of education, business and finance. Malta does not impose any language tests in its investor routes to residence or citizenship. Unlike many other European countries, Malta does not apply worldwide taxation to persons resident in Malta for tax purposes. Malta does not have any wealth taxes, property taxes, inheritance taxes or entry/exit taxes. Business taxation, referred to as corporate income tax is effectively 5% for Maltese companies owned by foreign shareholders despite their new Maltese citizenship.

European Residence & Citizenship Lawyers

Our European immigration lawyers advise on the various immigration routes in Europe. We dedicate personal attention to each client and oversee each immigration case individually. We help our clients assess which European citizenship route best suits their objectives and whether they qualify for relevant laws. As Maltese residence and citizenship agents with extensive experience of Maltese citizenship and investor immigration programmes, we offer a holistic coverage of all immigration and relocation and all relevant tax and legal services.

ACC Immigration Advisors (Malta company registration number C-44042) is duly authorised to act as a licensed Malta citizenship agent and holds licence number AKM-ACCA.

As we begin 2025, Malta’s Permanent Residence Programme (MPRP) continues to attract global attention, offering individuals and families the opportunity to secure long-term residency in one of Europe’s most sought-after destinations. This program, which allows non-EU nationals to establish residence in Malta, combines a high quality of life, access to the European Schengen Area, and a vibrant Mediterranean lifestyle. With its appealing benefits and growing popularity, the MPRP stands as a gateway for those seeking a new chapter in a stable and prosperous European nation. The programme has recently undergone changes as per Legal Notice 310 of 2024.

Malta Permanent Residence 2025

Third-country nationals, excluding those from the EU, EEA, and Switzerland, are eligible to the Malta Permanent Residence Programme 2025. However, individuals from currently sanctioned countries—namely Afghanistan, North Korea, Iran, the Democratic Republic of Congo, Somalia, South Sudan, Sudan, Syria, Yemen, and Venezuela—are ineligible. Additionally, applications from nationals of the Russian Federation and the Republic of Belarus are also not accepted at this time.

How to become a Permanent Residence of Malta?

A Main applicant applying under Malta’s Permanent Residence Programme (MPRP), must possess assets of at least €500,000, of which €150,000 must be in financial assets, OR assets totaling €650,000, with a minimum of €75,000 in financial assets.

Liquid/Financial assets include stocks, bonds, publicly listed/traded shares, funds and bank deposits, excluding cryptocurrency.

Inclusion of Family Members under the Malta Permanent Residence Programme

In the same application, the main applicant may include:

- The spouse or partner in a long and durable relationship

- Unmarried and financially dependent children up to the age of 28

- Financially dependent parents and grandparents of the applicant and of the spouse

What is the investment needed under the Malta Permanent Residence Programme in 2025?

The investor under the MPRP must make three different types of contributions and investment. These are split in: contribution & administrative fees paid to the government of Malta, a donation to charity and an investment into real estate.

Real Estate Investment

The main applicant must purchase or rent a property in Malta, which is to be kept for at least 5 years.

- Minimum Purchase Price: €375,000 for properties in Malta or Gozo.

- Minimum Annual Rent: €14,000 annually for properties in Malta or Gozo

Donation to Charity

The main applicant must make a donation to charity of €2,000

Government Administration Fees and Contributions

The main applicant must pay Government Administration Fees & Contributions as follows:

Main Applicant:

- A non-refundable administration fee of €50,000 is required:

- €15,000 payable within 1 month of application submission,

- Remaining €35,000 due within 2 months of receiving the Letter of Approval in Principle.

- Additional Government Contribution:

- For applicants purchasing property: €30,000

- For applicants renting property: €60,000

This Government Contribution must be paid within 8 months of the Letter of Approval in Principle.

Each Family member

- A fee of €10,000 per dependant, comprising:

- €5,000 as a non-refundable administration fee, payable within 2 months of the Letter of Approval in Principle, and

- €5,000 contribution payable within 8 months of the Letter of Approval in Principle.

What are the benefits of the MPRP?

Many are the benefits of the Malta Permanent Residence Programme, with the key advantages being:

- MPRP holders are granted the right to travel in the Schengen Area without a visa. The visa-free stay in the European Schengen Area is for 90 days out of 180 days.

- MPRP holders receive the right to work and live in Malta indefinitely.

- MPRP holders are not required to live in Malta for a minimum time in order to keep their permanent residence status.

- MPRP status is valid for life.

How to apply for Permanent Residency in Malta?

Under the Malta Permanent Residence Programme Regulations (L.N. 310 of 2024), investors cannot apply for permanent residence independently. Instead, a licensed agent accredited by the Government of Malta ensures the investor complies with all programme requirements. The agent provides comprehensive support throughout the process, from document preparation to the issuance of the permanent residence card.

Dr Priscilla Mifsud Parker is a Licensed Agent under the Malta Permanent Residence Programme (MPRP) regulations with Licence AKM-ACCA.

The Malta Permanent Residence Programme (MPRP) continues to be a popular choice for third-country nationals seeking to reside in Malta.

Following the publication of Legal Notice 310 of 2024 on the 19th of November 2024, the Residency Malta Agency (RMA) has announced a number of significant amendments. These updates address changes to the Malta Permanent Residence Programme (MPRP) submissions starting from the 1st of January 2025.

Key Features of the current MPRP Regulations

- Eligibility Criteria: Applicants must possess capital assets of at least €500,000, with €150,000 in financial assets. They must also lease a property for a minimum of €10,000 per annum in the South of Malta or Gozo, or €12,000 per annum in the North of Malta. Alternatively, they can purchase a property valued at €300,000 in the South of Malta or Gozo, or €350,000 in the North of Malta

- Contribution Requirements: A non-refundable contribution of €68,000 is required when purchasing a property, or €98,000 when renting. Additionally, applicants must donate €2,000 to a Malta-registered NGO or charity organisation as approved by the agency.

- Health Insurance: All applicants and their dependants must have a health insurance plan covering all risks in Malta

- Dependants: The programme allows for the inclusion of the main applicant’s spouse, unmarried and financially dependent children without any age limitations, and parents or grandparents who are wholly maintained by the main applicant

Malta Permanent Residence Programme Proposed Changes for 2025

- Revised Eligibility Criteria: From January 1, 2025, applicants have two options to show that they are economically self sufficient.

Option 1: The main applicant must present evidence of assets valued at not less than €500,000, with a minimum of €150,000 in financial assets, or

Option 2: The main applicant must present evidence of assets valued at not less than €650,000, with a minimum of €75,000 in financial assets

- Dependants’ Age Limit: A child of the main applicant or their spouse is eligible as a dependant as long as they have not yet reached the age of 29, are unmarried, and still financially dependent on the main applicant

- Qualifying Property: The minimum value for qualifying owned property will be €375,000, and the minimum annual rent for qualifying rented property will be of €14,000. This therefore removes the difference between investing in Malta or in Gozo/South of Malta.

- Administration Fees and Contributions:

-

- A non-refundable administration fee of €50,000 is to be paid for the main applicant, with €15,000 payable within one month of application submission and the remaining €35,000 within two months of receiving a Letter of Approval in Principle.

-

- Dependants’ fees include a €10,000 fee for each dependant, with €5,000 as a non-refundable administration fee payable within two months of receiving a Letter of Approval in Principle, and the remaining €5,000 contribution payable within eight months.

-

- A contribution of €30,000 will apply for the main applicant if opting for a qualifying owned property, or €60,000 if renting a property. This shall be payable within eight months of receiving a Letter of Approval in Principle.

Applications Submitted Prior to 2025

Applications submitted under the regulations prior to the publication of Legal Notice No 310 of 2024 will be accepted until December 31, 2024. These applications must include the minimum required documentation, such as Form MPRP 1, Form MPRP 10 for the main applicant and each dependant, Power of Attorney, certified true copies of passports, and a declaration signed by the main applicant

All remaining documentation must be submitted by the 28th of March 2025, or the application will be considered withdrawn.

The MPRP is designed to attract high-net-worth individuals and their families, offering them the opportunity to enjoy the benefits of residing in Malta, including a favorable tax regime and a high quality of life.

Our Malta Permanent Residence Services

At ACC, a licensed Maltese Immigration Firm (Licence No. AKM-ACCA), we specialize in guiding high-net-worth international families and businesses across a range of areas, including residency and citizenship, corporate law, taxation, financial services, fintech, and property. For over 20 years, our dedicated Malta Permanent Residence specialists have successfully assisted hundreds of individuals and families, from expatriate retirees to emigrants seeking new career opportunities. We proudly promote Malta as a prime destination for investment and relocation, reflecting the country’s rich tradition of hospitality and multiculturalism.

Our team provides expert advice on the legal and tax implications of the residence application process, offering tailored guidance to ensure compliance and efficient timelines based on your unique circumstances. We cover the requirements of various residence schemes in Malta and offer practical support for relocation needs, including transportation, insurance, schooling, and healthcare coverage. Let us help make your transition to Malta seamless and rewarding

The sunny Mediterranean island of Malta, with its stunning landscapes and vibrant culture, has become an attractive destination for UK citizens looking to start a new chapter in life. Whether for work, retirement, tax considerations or a better climate, moving to Malta from the UK offers a wealth of opportunities.

Immigrating to Malta from the UK: A Complete Guide

Since Brexit, UK citizens are no longer EU nationals, which means different rules now apply to them when moving to Malta. This article covers the key aspects UK citizens should know about Malta’s visa, residency, and citizenship options.

Why Moving to Malta from the UK?

- Quality of Life: Malta boasts a high standard of living, excellent healthcare and a reputable education system. The island is known for its friendly locals and vibrant expat community, making it easy to adapt.

- Strategic Location: Positioned in the heart of the Mediterranean, Malta serves as a gateway to Europe, North Africa, and the Middle East, enhancing travel and business opportunities.

- Language: English is one of the official languages in Malta, making communication straightforward for UK citizens relocating to Malta.

- Mild Mediterranean Climate: Malta’s warm Mediterranean climate, with long summers and mild winters, is a major draw for those looking to escape the colder UK weather. The island offers a relaxed outdoor lifestyle with numerous beaches, historical sites, and cultural events to enjoy throughout the year.

- Stable Economy and Safe Environment: Malta enjoys a stable economy with a growing financial services and technology sector, making it a good destination for professionals seeking new opportunities. Additionally, Malta is known for its low crime rates, providing a safe and secure environment for families.

- Favourable Tax Regime: Malta’s tax system is highly appealing, particularly for individuals with foreign-sourced income. Non-domiciled residents can benefit from a 15% flat tax rate on foreign income remitted to Malta under the Global Residence Programme, with no tax on income not remitted to the island. This is a significant advantage for retirees, investors, and expatriates with overseas earnings.

Malta Visa Requirements for UK residents and BRP Holders

UK citizens can enter Malta without a visa for short stays of up to 90 days within a 180-day period under the Schengen Zone rules. However, for long-term relocation, applying for a residence permit may be required based on the individual’s circumstances.

Before travelling to Malta one requires:

- Valid Passport: A passport which is valid for at least three months beyond the planned departure date from Malta.

- Travel Insurance: A comprehensive travel insurance policy is highly recommended to cover potential medical emergencies or trip cancellations.

- Return Ticket: Show proof of onward or return travel, as well as accommodation details.

British passport holders

Post-Brexit, UK passport holders no longer have the automatic right to live and work in Malta. If you plan to stay beyond the 90-day visa-free period, you’ll need to apply for the appropriate residency permit.

BRP holders (Biometric Residence Permit)

If you’re a UK resident with a BRP (such as non-UK nationals or third-country nationals living in the UK), you would generally need a visa to enter Malta. The visa requirements depend on your nationality.

Malta Residency Options for UK Citizens

UK citizens have several routes to acquire residency in Malta, depending on their objectives and whether they wish to work, retire, apply for a special tax status, obtain permanent residency or simply enjoy an extended stay on the island. The primary residency options include:

Malta Permanent Residence Programme (MPRP) for UK citizens

UK citizens can apply for permanent residency under the Malta Permanent Residency Programme (MPRP) if they can demonstrate they are in possession of at least €500,000/650,000 in capital, satisfy specific background checks and meet the health insurance requirements. Once approved, applicants are required to buy or rent property in Malta, give a small donation to charity and pay a government fee.

MPRP Requirements for UK citizens – updated with latest 2025 amendments

Buy a property in Malta or Gozo and spend at least €375,000

OR

Rent a property in Malta or Gozo and spend at least €14,000 per annum

AND

Pay a non-refundable contribution of:

- €80,000 if the property is purchase

- €110,000 if the property is rented

An additional contribution payment of €10,000 for each dependant is also due.

AND

Donate at least €2,000 per family to a charity in Malta.

Global Residence Programme (GRP)

The Global Residence Programme is a special tax programme whereby applicants are subject to tax in Malta at a flat rate of 15% on any foreign income remitted to Malta and a flat rate of 35% on any locally generated income. UK nationals applying for the GRP are required to annually declare that they didn’t spend more than 183 days in a calendar year, in any other one jurisdiction.

GRP Requirements for UK citizens

Buy a property in the South of Malta or Gozo and spend at least €220,000 or spend €275,000 in the North/Central Malta.

OR

Rent a property in the South of Malta or Gozo and spend at least €8,750 per annum or €9,600 if the property is chosen in the North/Central Malta.

AND

Pay a non-refundable administrative fee of €6,000

AND

Pay an annual minimum tax of €15,000

Malta Work Permit for UK citizens

If you have a job offer in Malta, you will need to apply for a work permit. Your employer typically assists with this process, which involves applying for a Single Permit that combines both work and residence permits.

Malta Citizenship for UK Citizens

UK citizens looking for a more permanent status may consider obtaining Maltese citizenship. There are three main routes available: citizenship through naturalisation, citizenship by descent and citizenship by investment.

Malta Citizenship by Investment

Applying for Maltese citizenship through the Granting of Citizenship by Direct Investment for Exceptional Services requires a significant contribution to Malta’s economic development, a donation to charity, as well as a property investment or rental. The application process typically takes 12 to 36 months, depending on the level of investment and the applicant’s circumstances. Once citizenship is granted, applicants gain the right to live, work, and travel freely across the EU, as well as visa-free travel to over 190 countries.

Applicants must contribute to the Maltese economy through a combination of financial investments:

Pay a non-refundable government contribution of:

- €600,000 (if applying for citizenship after 36 months of residency)

OR

- €750,000 (if applying for citizenship after 12 months of residency)

Pay an additional non-refundable contribution of €50,000 for each family member included in the same application.

Donate at least €10,000 to a registered philanthropic, cultural, sport, scientific, animal welfare or artistic non-governmental organisation in Malta.

Choose a Qualifying Property to be kept for 5 years. This can be done either by:

- Purchasing a property worth at least €700,000

OR

- Renting a property with a minimum annual rent of €16,000.

Malta Citizenship by Naturalisation

After residing in Malta for five years, UK citizens may apply for Maltese citizenship by naturalisation. This process involves demonstrating strong ties to Malta, including integration into Maltese society. Applicants will need to meet language and residency requirements. Such applications are subject to the discretion of the Minister responsible for citizenship.

Maltese Citizenship by Descent

UK citizens who have Maltese ancestry may be eligible for Maltese citizenship by descent. This route is open to individuals who can prove that they have Maltese parents, grandparents, or even great-grandparents,

Benefits of Maltese Citizenship

Many are the advantages of Maltese Citizenship. You can find a detailed guide on the benefits of Citizenship by Direct Investment in this dedicate article.

- Travel Freedom: Maltese citizens enjoy visa-free travel across the EU and Schengen Area and also benefit from visa-free travel or visa on arrival in more than 190 countries, enhancing global mobility.

- Quality of Life: Malta offers a high standard of living, excellent healthcare, and a warm climate, making it an attractive destination for families and retirees.

- Cultural Richness: The island’s rich history and thriving community provide a unique lifestyle experience, with numerous festivals, culinary delights, and outdoor activities.

Malta offers a range of appealing options for UK citizens looking to relocate, from residency to full citizenship through naturalisation, descent or investment routes. Given the post-Brexit changes, it’s important to review the latest legal requirements and speak to a licensed Maltese Immigration lawyer to ensure the correct steps are taken.

On the 4th October, the Advocate General of the Court of Justice of the European Union (CJEU), Mr Antony Michael Collins, delivered an opinion on the court case which the European Commission brought against Malta in relation to the granting of citizenship by investment (Case C‑181/23). In Malta, it is possible for individuals to apply for citizenship by investment through the Granting of Citizenship for Exceptional Services Regulations.

During the first hearing, Malta confirmed that during the granting of citizenship for exceptional services by direct investment process, a one year or three-year legal residence is required. The European Commission on its end confirmed that its main complaint is based upon the existence of a requirement under European Union Law that there must be a genuine link between the country granting citizenship and the person receiving it, in order to preserve the integrity of EU citizenship. Hence the European Commission is seeking a ruling by the Court that by establishing a citizenship by investment regulations for pre-determined investments mentioned in Maltese law, without a requirement of a genuine link, Malta is failing to fulfil its obligations under Article 20 TFEU and the principle of since cooperation between EU Member States.

European Union Citizenship

EU citizenship is established by Article 20 (1) TFEU. In accordance with this article any individual holding citizenship of a member state shall be also a citizen of the European Union. Article 9 TEU further provides that EU citizenship is additional to and does not replace national citizenship. Declaration number 2 on nationality of member states annexed to the Treaty on European Union, makes it clear that ‘wherever in the Treaty establishing the European Community reference is made to nationals of the Member States, the question whether an individual possesses the nationality of a Member State shall be settled solely by reference to the national law of the Member State concerned’.

Article 9 TEU, Article 20(1) TFEU and Declaration No 2 do not allow institutions of the European Union or Member states, the right to to introduce any conditions for the recognition of the citizenship of another Member State.

The role of the Advocate General

The office of the Advocate General was introduced under the Treaty of Rome. Advocates General are members of the Court of Justice of the EU, and are appointed under the same procedure as judges, however unlike judges they only have an advisory role and do not take part in the decision making process of the Court. The Advocate General assists the court by writing impartial opinions which although not binding are often followed by the CJEU.

Advocate General Opinion

In his opinion, Advocate General Anthony Collins held that in a spirit of mutual respect and trust, European Member States have agreed to abide by the decisions of each other as to whether an individual holds the nationality of a Member State and, therefore, EU citizenship.

It follows that while a Member State, in accordance with its own domestic citizenship laws, may require proof or evidence of a genuine link, there is no definition or requirement of such under European Law. EU law accepts such a requirement under the national law of Member States in the context of withdrawal and revocation of citizenship, provided the principle of proportionality is respected and certain procedural guarantees are afforded to the individual affected.

When it comes to International Law, Advocate Collins held that it is true that in the Nottebohm Judgement, the International Court of Justice confirmed that a country may refuse to recognize nationality granted by another country, in the absence of a genuine link or connection, however such a ruling is limited to allowing States to withhold recognition of nationality granted in the absence of a genuine link between a person and the State of which she or he claims to be a national. It does not oblige countries to require that such a connection exists either between them and their own nationals or between other States and their nationals.

The Nottebohm judgment also confirmed that the requirements for the granting of citizenship are a matter for individual states, hence there is no significant difference between EU and international law on the requirement of a genuine link as neither imposes such a requirement.

It follows that, in the opinion of the Advocate General, the European Commision has failed to prove that in order to lawfully grant citizenship, Article 20 TFEU requires the existence of a ‘genuine link’ between a Member State and an individual other than that which a Member State’s domestic law may require. On this point, it is important to point out that Maltese citizenship rules do require applicants to demonstrate “evidence of personal, commercial, financial ties with the country”, in addition to satisfying the minimum investment criteria of the rules.

Key Takeaway

The opinion of the Advocate General reinforces the notion that citizenship remains the exclusive and sovereign right of each Member State provided it does not undermine or breach EU law. Hence citizenship by investment regulations, such as Malta’s are in accordance with EU law as long as the appropriate safeguards and due diligence processes are in place, in order not to disrupt the principles of trust and cooperation between Member States.

Another important takeaway in the opinion was that while the competence to grant nationality is reserved to the individual Member, the withdrawal of European citizenship is subject to a number of identifiable constraints. Arising from concerns that the revocation of national and hence EU citizenship, may render individuals stateless and deprive them of rights granted under the Treaties and the Charter, EU law guarantees a minimum standard of legal protection to persons who find themselves in such circumstances

What happens next?

Is it important to point out that the Advocate General’s Opinion is not binding on the CJEU but such opinion proposes to the court, a legal independent solution to the case in front of it. The Judges of the Court of Justice will now deliberate on the case and give a final judgement at a later date.

Applying for Maltese citizenship or residence, and relocating to Malta is an exciting venture, offering a blend of Mediterranean charm and weather with sunny summers and mild winters. Malta also boasts a rich historical and cultural heritage with numerous UNESCO World Heritage Sites, including the ancient Megalithic Temples and the historic city of Valletta. The fusion of different cultural influences, from the Phoenicians to the British, creates a unique and fascinating environment. Malta offers a high quality of life with a strong sense of community, low crime rates, and excellent healthcare and educational services.

As you prepare to make this beautiful island your home, choosing the right property is a crucial step. Here’s a guide to help you navigate the property market in Malta and find the perfect place to call home.

Understanding the Maltese Property Market

The Maltese property market is diverse, catering to various tastes and budgets. From historic townhouses in Valletta to modern apartments in Sliema and luxury villas in St. Julian’s, there’s something for everyone. Understanding the local market trends, property types, and legal considerations is essential for making an informed decision.

Should I buy or rent?

Deciding whether to buy or rent property in Malta depends on your personal circumstances, financial situation, residency or citizenship by investment programme minimum spend requirements and long-term plans.

Buying property can be a solid investment due to Malta’s stable real estate market and very good potential for property value appreciation. It offers the benefits of owning something you can call your own, the right to make any amendments to the property and the right to rent it out. On the latter point, one needs to consider whether the investment migration programme under which the property is bought allows the rental of the qualifying property.

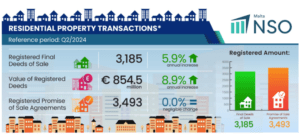

In a recent publication by the Maltese National Statistics Office (NSO) issued in June 2024, there is a clear indication that Residential Property Transactions were on the increase. A snippet of the results can be found below:

Renting, on the other hand, provides more flexibility, lower initial costs, and less responsibility for property upkeep. It is ideal for those who may be staying short-term or wish to get to know the island better before they commit to purchase. Ultimately, the decision should align with your financial readiness, lifestyle preferences, and future goals.

Location is key

Your choice of location will significantly impact your lifestyle in Malta. Here are some popular areas to consider:

- Valletta: The capital city, known for its historical significance and vibrant cultural scene. Ideal for those who appreciate history and urban living.

- Sliema and St. Julian’s: These bustling coastal towns offer a mix of shopping, dining, and nightlife. Perfect for expats and young professionals seeking a lively environment.

- Gozo: Malta’s sister island, known for its tranquil and laid-back lifestyle. Great for those looking for a quieter, more rural setting.

- Mellieha and St. Paul’s Bay: These northern towns provide beautiful beaches and a more relaxed pace of life, suitable for families and retirees.

- Lija, Attard and Balzan: Often referred to as ‘The Three Villages’ situated in central Malta. Fitting for individuals who need to travel around the island frequently and with ease.

Property Types

Malta offers a range of property types to suit different preferences:

- Apartments: Available in various sizes, from studios to spacious penthouses. Apartments are popular in urban areas and often come with present-day amenities.

- Houses of Character: These are highly sought after for their unique charm and historical significance, providing a living experience that is deeply connected to Malta’s cultural heritage.

- Townhouses: These properties offer a combination of traditional Maltese architecture and contemporary comforts. They are generally newer than houses of character, often from the late 19th to early 20th centuries, with a more uniform architectural style.

- Villas: Often found in more suburban or rural areas, villas provide luxury, privacy, and ample space, perfect for families or those seeking a more secluded residence.

- Farmhouses: Particularly in Gozo and rural Malta, farmhouses offer rustic charm and expansive grounds, appealing to those desiring a connection to nature.

Budget Considerations

The cost of property in Malta can vary widely depending on the location and property type. Urban areas like Sliema and St. Julian’s are generally more expensive than rural or less central areas. Establish a clear budget and consider additional costs such as property taxes and notary fees if you are purchasing, maintenance, and utilities.

Most houses would already have electricity and water supplies. For newly built properties, one would need to apply for these utilities through Arms Ltd.

One other consideration is the minimum property thresholds established by the chosen residence programme. We hereby outline the property requirements for Non-EU nationals seeking Permanent Residence in Malta:

- Rent a property for:

- €10K per year if the property is in Gozo or South of Malta

- €12K per year if the property is in Central or North of Malta

OR

- Purchase a property for:

- €300,000 if the property is in Gozo or South of Malta

- €350,000 if the property is in Central or North of Malta

On the other hand, if opting to apply for citizenship by investment in Malta, the minimum value to purchase a property is of €700,000, and when renting a property, it is of €16,000 annually.

Legal and Administrative Steps

Whether you decide to go for property rental or purchase, it is always prudent to appoint a property lawyer to oversee the property transaction and guide you accordingly.

Purchasing property in Malta involves several legal and administrative steps:

- Due Diligence: Conduct thorough checks on the property’s title and any potential encumbrances. This task is usually carried out by a notary who is usually appointed by the purchaser.

- Purchase Agreement: Once you find a property, a preliminary agreement (Konvenju) is signed, outlining the terms and conditions of the sale.

- Permits and Taxes: Non-EU citizens may require an Acquisition of Immovable Property (AIP) permit. Be aware of taxes such as stamp duty and property registration fees.

Lifestyle Considerations

When choosing your property, think about your lifestyle needs:

- Proximity to Amenities: Consider the property’s proximity to schools, healthcare facilities, supermarkets, and recreational areas.

- Transport Links: Ensure good connectivity to public transport or main roads if you plan to commute.

- Locality Atmosphere: Research the neighborhood’s community vibe and ambiance to ensure it aligns with your preferences.

Final Thoughts

Choosing the right property when setting up residence in Malta involves careful consideration of location, property type, budget, and residence programme requirement. By understanding the local market and aligning your choice with your lifestyle needs, you can find a property that not only meets your practical requirements but also enhances your living experience on this stunning Mediterranean island. Whether you seek the hustle and bustle of urban life or the serenity of a rural retreat, Malta offers a wealth of options to create your perfect home.

Relocating to a new country with children is a significant life change that involves careful planning and consideration. Malta, an island in the Mediterranean, offers a unique blend of historical richness, vibrant culture, a safe location and a welcoming environment, making it an attractive destination for families. However, relocating to Malta with minors requires attention to several important aspects to ensure a straightforward move.

This article covers the essential considerations for your family!

Legal Requirements and Documentation

Residence Permits

Before relocating, it is crucial to understand the available residence permit options. Citizens of the European Union (EU) and the European Economic Area (EEA) do not need a visa to enter Malta but must apply for a residence permit if they plan to stay longer than three months.

Non-EU citizens, depending on their country of origin, may need a visa to enter Malta and must also apply for a residence permit. The most sought-after option for Non-EU nationals is the Malta Permanent Residence Programme (MPRP) which includes all the family members in one application. It is advisable to contact a local Licensed Agent such as ACC Advisors to assist with your application.

Documentation for Minors

It is important to ensure that minors have a valid passport. Depending on the country of origin, additional documents such as birth certificates and custody papers (if applicable) may be required. All documentation submitted for residence application in Malta need to be translated into English.

Education

School Enrolment

Malta boasts a robust educational system with public, church, private, and international schools. Public schools follow the Maltese curriculum and instruction is primarily in English and Maltese. Private and international schools offer various curricula and most lessons are conducted in English.

Below one can find a list of private schools and universities in Malta:

Schools

- Chiswick House School – https://www.chs.edu.mt/

- QSI International School of Malta – https://malta.qsi.org/

- San Andrea School – https://www.sanandrea.edu.mt/

- San Anton School – https://www.sananton.edu.mt/

- Saint Edwards College – https://stedwards.edu.mt/

- Verdala International School – https://www.verdala.org/

Universities

- University of Malta – https://www.um.edu.mt/

- American University of Malta – https://aum.edu.mt/

- Barts and the London School of Medicine – https://www.qmul.ac.uk/malta/

Language Considerations

English and Maltese are both official languages of Malta. While English is widely spoken, learning basic Maltese phrases can enrich your family’s experience and help your children integrate better into the local culture and school environment.

If the applicants moving to Malta wish to integrate even more, they can enrol in a Maltese for foreigners course. In addition, international schools often have language support programmes to help non-native English speakers.

Healthcare

Health Insurance

EU/EEA citizens can access public healthcare services in Malta with their European Health Insurance Card (EHIC). Non-EU nationals must have a private health insurance policy unless they work in Malta and contribute to Malta’s national insurance and social security.

Vaccinations

Ensure your child’s vaccinations are up to date according to your home country’s schedule. Malta has a comprehensive vaccination programme, and you may need to show proof of vaccinations for school enrolment.

Housing

Finding a Suitable Home

When looking for a property to buy or rent, consider factors such as the minimum qualifying value depending on the immigration programme chosen, proximity to schools and recreational areas for example playgrounds, kids focused activity centres like Esplora and restaurants with play areas for the kids.

Popular residential areas for expatriate families include Sliema and St. Julians while other families prefer quieter, more central areas like Balzan, Lija, Naxxar and Attard.

Financial Considerations

Cost of Living

The cost of living in Malta is generally comparable to that of other European countries. Everyday expenses, including groceries and dining out are reasonable. Public transport is provided for free for all Maltese residents.

Health insurance costs are relatively affordable especially for minors, while tuition fees for private and international schools can be expensive. Housing costs can vary depending on the location and type of accommodation chosen.

Support Networks

Expat Communities

Malta has a vibrant expatriate community. Joining expat groups, can provide valuable support and advice, helping your family settle in more quickly.

Local Support Services

There are various local organizations and services designed to help families, including family support groups, and child welfare services.

It is always advisable to prepare minors psychologically before the transition to another country actually takes place. If kids are still overwhelmed by the emotional journey associated with the relocation itself, there are many support services offered by various professionals in Malta that help ease the minor’s worries.

Plan of Action

Relocating to Malta with children involves thorough preparation, from securing the necessary residence permits to selecting the right school and integrating into the local community. Malta’s blend of Mediterranean charm, historical depth, and modern amenities makes it a fantastic place for families. By addressing the key areas outlined in this guide, you will be on the right track for a successful shift towards your new life in Malta.

Contact one of our Professional Advisors if you wish to learn more about relocating to Malta. ACC is a licensed agent in Malta and can assist with your relocation. (AKM-ACCA)

In recent years, the socio-political landscape in Lebanon has been marked by significant instability. Economic downturns, political uncertainty, and security concerns have compelled many Lebanese nationals to seek alternative options for a stable and secure future. Among these alternatives, the Malta Permanent Residence Programme (MPRP) has emerged as the preferred European residence solution for a different number of reasons.

A Safe Haven in the Heart of the Mediterranean

Malta, a member of the European Union and the Schengen Area, is renowned for its political stability, robust economy, and high quality of life. The island nation provides a safe and secure environment, making it an attractive destination for those fleeing regions of turmoil. For Lebanese nationals, Malta’s PR Programme offers a permanent residence status in a country that is both geographically and culturally accessible.

A Maltese permanent residence application can include up to four generations applying together in one application. The PR status becomes effective for all the family members immediately on application approval.

Economic and Financial Security

One of the primary benefits of Malta, is the economic stability it promises. Unlike Lebanon, which has faced severe financial crises and currency devaluation, Malta boasts a solid economy with a resilient banking sector. Permanent residents of Malta benefit from a favourable tax regime, including no wealth, inheritance, or property taxes, making it an appealing option for Lebanese investors and businesspeople looking to protect and grow their assets.

Access to the Schengen Zone

Obtaining permanent residence in Malta comes with the significant advantage of access to the Schengen Zone. Apart from the right to live in Malta indefinitely, under the MPRP Lebanese nationals can travel freely within the Schengen Zone with a maximum stay of 3 months in every 6 months. For businesspeople, this means enhanced commercial opportunities without having to secure a Schengen Visa for each trip.

A Streamlined Residency Process

The Malta Permanent Residence Programme is designed to be efficient and straightforward. Applicants must satisfy the following investment requirements:

- Pay a one-time application fee and contribution to the Government of €110,000 when renting a property or €80,000 if purchasing a property (an additional contribution of €10,000 per family member included in the application is also due), and

- Rent a property in Malta or Gozo for €14,000 OR purchase a property for €375,000 and

- Pay a donation of €2,000 to a local registered philanthropic, cultural, sport, scientific, animal welfare or artistic NGO.

Furthermore, the main applicant needs to declare and provide evidence that s/he is in possession of assets having a value of not less than €500,000 out of which a minimum of €150,000 shall be in the form of financial assets. Applicants may also opt to present a capital of €650,000, with at least €75,000 in the form of financial assets.

All the family members included in the PR application need to pass the necessary background checks and be deemed as fit and proper to proceed with an MPRP application.

The investments mentioned above are only required after the approval of the MPRP application. This makes the process transparent and well-regulated, ensuring that applicants can achieve residency status without unnecessary complications or delays.

Quality of Life and Cultural Affinity

Malta offers a high standard of living with a blend of Mediterranean charm and modern amenities. The country is known for its excellent healthcare system, diverse educational institutions, and a rich cultural heritage. For Lebanese nationals, the cultural similarities, such as the Mediterranean lifestyle, cuisine, hospitality and language resemblances, make Malta a comfortable and familiar environment to consider.

Long-Term Stability and Peace of Mind

In a region where uncertainty is the norm, the ability to plan for the long term is invaluable. Malta’s Permanent Residence Programme provides Lebanese nationals with peace of mind, knowing they have a secure and safe place to call home. This stability and the lifetime permanent residency status, allows families to focus on building their futures, whether through education, business ventures, or simply enjoying a higher quality of life.

At the same time, the Maltese Permanent Residence Programme does not impose any annual physical stay in Malta. This makes it easier for families who might seek PR as a Plan B for their families.

Conclusion

As Lebanon continues to navigate its challenges, the Malta Permanent Residence Programme stands out as a viable and attractive solution for Lebanese nationals seeking a safe harbour. The combination of economic benefits, possibility to relocate to Malta, access to the Schengen Zone, and a high quality of life makes Malta an ideal destination. For many Lebanese families, the MPRP is more than just a residency programme; it is a gateway to a brighter, more stable future.

An application under The Malta Permanent Residence Programme (MPRP) may only be submitted via the services of a licensed agent. ACC is a licensed agent in Malta and can assist with MPRP applications. (AKM-ACCA)

Amendments have been implemented to the legislation earlier this month by L.N.57 of 2024, amending the Malta Permanent Residence Programme Regulations (MPRP) and L.N. 56 of 2024, amending the Malta Residence and Visa Programme Regulations (MRVP).

The objective of these amendments is to clarify a number of matters for the better implementation of both programmes. The main amendments from these two legal notices are:

Malta Permanent Residence Programme (MPRP)

- Additional dependants can be exempted from the provision of a health insurance if they do not apply for a residence card;

- Residency Malta has the right to stop the benefits of a certificate while conducting an investigation;

- The Agency can exchange information with other authorities empowered to request information.

Malta Residence and Visa Programme (MRVP)

- Residency Malta can withdraw/withhold residency cards if the dependants are not in possession of a health insurance policy;

- The Agency has the discretion to extend any time limit, upon good cause being shown, for applications concluded after the cut-off day.

The Malta Residence and Visa Programme (MRVP) was replaced by the Malta Permanent Residence Programme (MPRP) in March 2021, however, the Agency has maintained its monitoring and compliance function, by conducting checks on beneficiaries, according to law. Moreover, beneficiaries are still able to benefit from the programme if they need to add more dependants after the issuance of a Residency Certificate.

The Malta Permanent Residence Programme (MPRP) is a residency-by-investment programme based on investments in property and government contributions, designed to attract non-EU nationals who wish to obtain permanent residency in Malta.

Benefits:

- the right to settle, stay and reside permanently in Malta;

- enjoy Visa-free travel across Schengen;

- penetrate Malta’s affordable real estate market;

- may include up to four generations in an application.

Eligibility and Requirements:

- be third country nationals, non-EU, non-EEA and non-Swiss;

- not hail from sanctioned countries, as announced from time to time by the Agency;

- not benefit under other pertinent regulations and schemes;

- be in receipt of stable and regular financial resources, sufficient to maintain themselves and their dependants, without recourse to the social assistance system of Malta;

- show they have capital assets of not less than €500,000, out of which a minimum of €150,000 must be financial assets. Applicants may also provide a capital of €650,000, with €75,000 of that amount required to be in the form of financial assets.;

- be fit-and-proper individuals and have a clean criminal record;

- not pose any potential threat to the national security, public policy, public health or public interest.

Nestled in the heart of the Mediterranean with wonderful sandy and rocky beaches, a pro-business perspective, high academic standards, premium health services and a Mediterranean climate are some of the factors that make Malta a welcoming nation. This archipelago of islands consisting of Malta, Gozo and Comino offers an enticing environment for investing seeking a strategic location in Europe. English is also an official language of Malta making it easier for foreigners to relocate or get accustomed with the island and its residents.

By means of the Granting of Citizenship for Exceptional Services Regulations, Maltese law allows for the granting of citizenship by a certificate of naturalisation to foreign investors and their families who contribute to the economic development of Malta by making a contribution to a state fund, donate to charity and rent or buy a property on the island.

Why is the Maltese Citizenship by Direct Investment Programme (MCES) so significant in today’s world where everyone is seeking peace of mind for their families? Hereunder, we explore the benefits of this exciting journey:

Investment is only required after approval

A significant advantage of the Maltese Citizenship by investment regulations is that the investment is made only after the application has been approved. This gives additional reassurance to the applicants who would first receive their approval and then proceed with the investment.

One application for all the family

An application for citizenship can include up to four generations in one application. This includes the main applicant, spouse, dependent unmarried children under the age of twenty-nine and also dependent parents and grandparents over the age of fifty-five of both the main applicant and the spouse.

Right to reside and settle permanently in Malta

Obtaining Maltese citizenship will give its holder and family members the right to reside permanently in Malta and in any European country. Malta provides an exceptional quality of life, which makes it an attractive destination for those seeking a balanced lifestyle. The island’s accessibility, diverse recreational opportunities, and high standard of living contribute to a thriving community that complements the business landscape.

Dual Citizenship is allowed

Malta allows dual and multiple citizenship, and this means that applicants who obtain Maltese Citizenship by Direct Investment do not need to give up their previous nationality. This is particularly advantageous for those who want to preserve their ties to their home country while gaining access to the advantages that come with Maltese citizenship.

Citizenship granted to future generations

One notable advantage of Maltese citizenship is its intergenerational accessibility, allowing the enjoyment of citizenship to extend seamlessly to future generations. This unique feature ensures that descendants can inherit the rights and privileges associated with Maltese citizenship, creating a lasting and meaningful legacy, irrespective of the place of birth.

Citizenship in a safe environment

Malta is regarded as one of the safest countries in Europe and this has captivated the interest of many families looking for a secure and stable jurisdiction. Malta has also earned a solid reputation among world travelers and migrants especially since crime rates in Malta have always been low compared to other destinations.

A country with economic and political stability

Malta’s economy has experienced a robust economic growth with a remarkable post-pandemic recovery. The country’s economy showed strong advancement and has been historically attracting significant foreign direct investment.

Reliable Healthcare

On becoming citizens of Malta, applicants have free access to all state health centres, community clinics and the Malta government hospital. All medical services are provided free of charge and delivered by a multi-professional team including doctors, physiotherapists, podiatrists, radiographers, speech and language pathologists, phlebotomists, social workers, dieticians, and nutritionists.

In addition, Maltese citizens also get access to the European Health Insurance Card which grants them emergency access to medical treatment in the EU.

Educational Advantages

Beneficiaries of Maltese citizenship will also have access to a high-quality education system which is free of charge. Additionally, one can also benefit from the ability to study in other EU countries under favourable conditions.

Right to live, work and study in Europe

Once the applicants become Maltese/EU nationals, they have the right to live and move within the EU and they would not require a permit to work in any EU country. They can also relocate to study in any member state of their choice.

Visa-free travel to over 190 destinations

In the 2024 passport index, the Maltese Passport has ranked fifth place globally. This ranking is based on the number of countries that an individual can access without a visa or with a visa on arrival with a certain passport. A Maltese passport holder benefits from visa free travel to 190 travel destinations including Australia, the European Union, USA and Canada amongst other countries. This facilitates hassle-free international travel, making it convenient for business, leisure, or other purposes.

Doing Business in Malta and Europe

Maltese nationals can set up, operate, and develop a business in Malta and in any country of the European Union and therefore benefit from various business expansion opportunities.

Property Investments

Investing in the Maltese real estate market has always been highly regarded since the land available on the island is limited and therefore it yields high returns both from rental and from property resale. On obtaining Maltese citizenship, individuals are free to purchase properties in all locations in Malta and no longer require an AIP permit.

In summary, obtaining Maltese citizenship provides a multitude of benefits, ranging from travel privileges and business opportunities to the ability to enjoy a high quality of life within the European Union. The flexibility of dual citizenship further enhances the appeal of Malta as a desirable destination for individuals seeking a well-rounded and globally connected lifestyle.

Challenges in applying for Maltese Citizenship

The Maltese Citizenship by Direct Investment programme requires the applicants to be residents of Malta for a period of 12 or 36 months and therefore it takes time to acquire a Maltese passport since there is a lengthy waiting period, mainly because of the four-tier due diligence exercise done by the authorities. Notwithstanding this, applicant still benefit from receiving a Maltese residence card within two weeks of submission of the application.

Another challenge is that the direct investment which is done to the Maltese Government Fund is non-refundable. This however is only to be paid once an application has been approved. Additionally, the qualifying property bought or rented to fulfil the programme requirements, cannot be rented out to third parties during the first five years holding period.

The Maltese Citizenship application process comprises of a very strict due diligence exercise on all the family members included in the application. Furthermore, applicants need to submit detailed information on how they generated their funds over the years. This assembling of documentation can be seen as cumbersome although at the same time it proves that Malta gives value to the integrity of the applicants to whom citizenship is being granted.

How to obtain Malta Citizenship by Investment

In order to be granted Maltese Citizenship by Direct Investment under the Granting of Citizenship for Exceptional Services Regulations, applicants are first required to visit Malta and apply for a residence card. Once the residence cards are issued in a period of around four weeks, applicants can then submit a citizenship eligibility application. Following a thorough due diligence exercise, and once the application has been approved the applicant is required to:

- Pay a government contribution of:

- €750,000 if applying for citizenship after 1 year of residence

OR

- €600,000 if applying for citizenship after 3 years of residence

Pay an additional €50,000 contribution for each dependant that the main applicant adds to the application. This can include the spouse, children up to the age of 28 and parents and grandparents of the applicant and of the spouse.

- Make a charity donation of €10,000 to a local NGO

- Rent or Purchase Property in Malta, which is to be kept for at least five years:

- Option 1 – Property Rental – The applicant should rent a property for a minimum value of €16,000 per year.

OR

- Option 2 – Property Purchase – The applicant should purchase a property for a minimum value of €700,000.

A Malta Citizenship by Investment application can only be submitted at Community Malta Agency via a Licensed Agent.

ACC Immigration (Malta company registration number C-44042) is duly authorised to act as a licensed Malta agent and holds licence number AKM-ACCA.